What Does Non Profit Org Mean?

Wiki Article

Non Profit Organizations List for Dummies

Table of ContentsHow Non Profit Organizations Near Me can Save You Time, Stress, and Money.How 501 C can Save You Time, Stress, and Money.The Ultimate Guide To Non ProfitGetting My Npo Registration To WorkA Biased View of Google For NonprofitsHow Google For Nonprofits can Save You Time, Stress, and Money.The Main Principles Of Google For Nonprofits The Facts About Npo Registration RevealedExamine This Report about Google For Nonprofits

Integrated vs - nonprofits near me. Unincorporated Nonprofits When people believe of nonprofits, they usually believe of incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Structure, as well as various other formally created companies. However, lots of individuals take part in unincorporated not-for-profit organizations without ever recognizing they have actually done so. Unincorporated not-for-profit associations are the outcome of 2 or more people working together for the function of giving a public benefit or solution.Exclusive structures might consist of household foundations, private operating structures, and corporate foundations. As noted over, they usually don't supply any kind of services and also rather utilize the funds they increase to support other philanthropic companies with solution programs. Personal structures additionally tend to require even more start-up funds to develop the company in addition to to cover lawful charges as well as various other ongoing expenses.

The smart Trick of 501c3 Nonprofit That Nobody is Discussing

The properties remain in the trust while the grantor is active and the grantor may take care of the possessions, such as dealing supplies or genuine estate. All assets transferred into or purchased by the depend on continue to be in the depend on with income distributed to the assigned recipients. These trust funds can make it through the grantor if they include a stipulation for continuous management in the documentation used to establish them.

Nonprofits Near Me Can Be Fun For Anyone

Additionally, you can employ a trust lawyer to help you create a philanthropic trust fund as well as recommend you on how to handle it progressing. Political Organizations While many other types of not-for-profit companies have a restricted ability to join or supporter for political task, political organizations run under various guidelines.

The Non Profit Organizations Near Me Statements

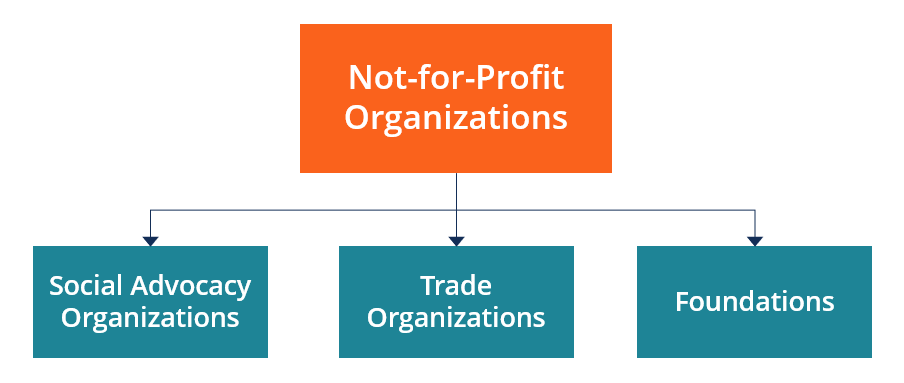

As you evaluate your choices, be sure to talk to a lawyer to establish the very best technique for your company and also to ensure its correct configuration.There are numerous types of nonprofit organizations. These nonprofits are generally tax-exempt because they pursue the general public rate of interest. All possessions and also earnings from the not-for-profit are reinvested right into the company or given away. Depending upon the nonprofit's subscription, goal, and also structure, various categories will use. Nonprofit Organization In the United States, there are over 1.

Rumored Buzz on Non Profit Organizations Near Me

Some examples of widely known 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, and also the International Association of Meeting Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or recreation clubs.

The 9-Second Trick For 501c3 Organization

Usual sources of earnings are subscription fees as well as contributions. 501(c)( 14) - State Chartered Credit History Union and Mutual Reserve Fund 501(c)( 14) are state legal lending institution and common book funds. These organizations offer economic services Go Here to their members and also his explanation the neighborhood, typically at affordable rates. Income sources are service tasks and also government gives.In order to be qualified, at the very least 75 percent of members need to exist or past participants of the USA Armed Forces. Funding comes from donations and also federal government grants. 501(c)( 26) - State Sponsored Organizations Giving Health And Wellness Protection for High-Risk Individuals 501(c)( 26) are nonprofit companies produced at the state degree to give insurance for high-risk people that may not be able to obtain insurance with various other means.

Non Profit - The Facts

Funding originates from donations or federal government gives. Examples of states with these risky insurance pools are North Carolina, Louisiana, and also Indiana. 501(c)( 27) - State Sponsored Workers' Settlement Reinsurance Company 501(c)( 27) not-for-profit organizations are developed to give insurance coverage for employees' payment programs. Organizations that give employees settlements are needed to be a profit business organization participant of these companies and pay dues.A nonprofit company is an organization whose function is something apart from making an earnings. non profit organizations near me. A nonprofit donates its profits to accomplish a particular objective that benefits the general public, rather than dispersing it to investors. There more than 1. 5 million not-for-profit organizations registered in the United States. Being a not-for-profit does not indicate the organization won't earn a profit.

All about 501c3 Nonprofit

No one person or group owns a not-for-profit. Possessions from a nonprofit can be offered, yet it benefits the entire organization instead of individuals. While any individual can include as a nonprofit, just those that pass the rigid standards established forth by the federal government can attain tax excluded, or 501c3, standing.We talk about the steps to coming to be a not-for-profit more into this page.

Excitement About Non Profit Organizations Near Me

One of the most essential of these is the capacity to acquire tax obligation "exempt" standing with the IRS, which allows it to get donations free of present tax, allows donors to deduct donations on their earnings tax returns and also exempts some of the organization's tasks from revenue taxes. Tax exempt status is vitally essential to lots of nonprofits as it urges contributions that can be utilized to sustain the goal of the organization.Report this wiki page